One of the most common claims of those who are opposed to wind farm

developments is that wind farm construction causes declines in property

values in the vicinity.

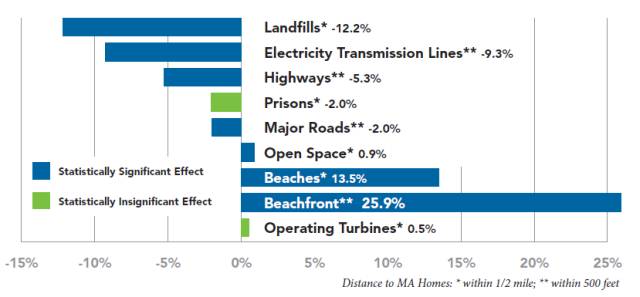

There is no good evidence that this is generally true; a number of studies

around the world indicate that wind farms have no, or very little, effect

on the values of nearby homes and land.

However, there have been isolated decisions indicating some declines in

land values in some places.

(The

Fairview case in Canada is interesting.)

Some people think wind turbines are ugly, others see them as clean and graceful examples of what a more sustainable future will look like; people in the former group would not want to live nearby, those in the latter group would be very happy to.

(I am very much in the latter group and look forward to the construction of a nearby

wind farm.)

There are

many reasons why people should look favourably on a nearby wind farm, not the least being the

community funding that most wind farms provide (at least in Australia).

When people hear of a proposed nearby wind farm they can be concerned about

noise problems.

Having made a point of visiting and listening to many wind farms under many circumstances, and having

slept under turbines in a tent many times in my opinion the noise quality and level is not a problem.

The graphs on the right were created using data from Propertyvalue.com.au by Victorian Greens MP Greg Barber.

Each is in an area where a wind farm has been built.

The graphs clearly show that there are no long-term declines in land values

associated with wind farms.

I have produced similar graphs from South Australian property values

(using realestate.com.au), but as they all show the same trend as Greg's

graphs it seems superflous to display them here.

There have been few property value studies near Australian wind farms, but

the

NSW Valuer General commissioned one in August 2009 which is useful:

"This study investigated eight wind farms across varying land uses (rural,

rural residential, residential) using conventional property valuation

analysis. Two wind farms were selected in NSW and six in Victoria.

The main finding was that the wind farms do not appear to have negatively

affected property values in most cases.

Forty of the 45 sales investigated did not show any reductions in value.

Five properties were found to have lower than expected sale prices (based on

a statistical analysis)."

The report went on to say that "No reductions in sale price were evident

for rural properties or residential properties located in nearby townships

with views of the wind farm", however "no firm conclusions" could be drawn

in the case of lifestyle properties.

(The report can be accessed

here.)

In the Australian case and concerning the land on which the turbines are

built, turbines are usually on the tops of hills where the land is too steep

to crop, so no cropping land is usually lost.

Animals, both wild

and domestic,

quickly get used to turbines and will happily graze right under them.

The value of a property is dependent on its earning potential and having

turbines on a property greatly increases earning potential.

The licensing fee normally paid by turbine operators to land owners is

typically at least $10 000 (around 2012).

(See also elsewhere).

So fairly obviously values of land having turbines on it are likely to

increase.

The

Waubra Wind Farm

is one of the Australian projects to receive a lot of news coverage, at

least partly because of the misleadingly named

Waubra Foundation.

Council records show rising land values in the Waubra part of the Shire.

In the Ballarat hearing of the Senate inquiry into the impact of wind farms

(2011/03/28) Councillor David Clark of the Pyrenees Shire Council said:

"We did a revaluation in early 2010, so six months after

Waubra wind farm was operating.

We did not see an effect on commercial agricultural land.

It had moved up and our belief is there were other factors driving the price

of that.

We did not see an effect on the nearby township of Waubra.

Prices again had moved up in the case of that township, which is about 1.2

to 1.5 kilometres away."

Two years later, in the Pyrenees Shire Council Meeting Minutes,

General Revaluation of Properties, 2012; of ten areas listed under

'Residentual Properties' Waubra shows the largest rise, 10.1%.

The average change of the remaining nine areas was a rise of 2.9%.

The valuations are done every two years.

In a curious decision in Victoria Magistrate Kate Hughes made a ruling

devaluing a property by 17% due to a nearby wind farm.

Ms Hughes seems only to have considered evidence from two land valuers,

'Raab and Raab'.

She seems not to have considered any of the highly-credible studies listed

on this page.

| House prices at Edithburgh

|

|---|

|

| Edithburgh is the closest South Australian town to a wind

farm,

Wattle Point,

which was completed in 2005.

|

The graphs on the right were all from Victoria.

This graph of house prices in Edithburgh, a South Australian town, uses values from

realestate.com.au and shows that prices there were not adversely affected either.

No other sizeable town in SA is within 3km of a wind farm. (Snowtown is about seven kilometres from Snowtown Wind Farm, Jamestown is about eight kilometres from Hornesdale WF and 12 kilometres from Mount Brown North WF.)