The scene in early 2018...

-

On-shore wind power continues to grow steadily world wide (and at record rates in Australia);

-

Off-shore wind power, while much smaller than on-shore, grows at exponentially increasing rates world-wide;

-

Solar photo-voltaic installation continues its exponential growth;

-

Solar thermal, with energy storage, while small compared to solar PV, was growing at an exponential rate;

-

The number of electric vehicles (which do not need fossil fuels) was increasing exponentially;

-

High-capacity battery manufacture was a huge and fast growing industry;

-

Pumped hydro energy storage installations were increasing quickly world-wide;

-

Super-capacitor development was looking very promising as another way of storing energy;

-

Energy to hydrogen installations were being built on a pilot scale in many places (at least two places in my state, South Australia, alone);

-

Technology development for converting hydrogen to ammonia and back was making renewable energy export increasingly viable (there was already a well developed liquid ammonia shipping industry).

All these were making fossil fuels in general, and coal in particular, less necessary for the world energy industries.

| |

| Sundrop Farms, Port Augusta, South Australia

|

|---|

| | Not only were renewable energy options replacing fossil

fuels in electricity generation, but also in powering industry; see

Sundrop Farms.

| |

An analysis by Sandbag and Agora Energiewende, and reported by Sophie Vorrath on

Renew Economy showed that renewable electricity generation had for the first time overtaken coal-fired power generation in Europe.

Coal use for power generation was declining while power generation by renewables was increasing.

The same article noted that:

"In 2017, Netherlands, Italy and Portugal added their names to the list of countries to phase-out coal..."

Damian Carrington, writing for The Guardian, had previously

reported that world-wide 19 countries had pledged to phase-out coal.

The Australian Energy Market Operator (AEMO) reported a 50-fold incease in

applications for new wind and solar projects across Australia in May 2017.

This was attributed to continued declines in the prices of both wind and

solar power.

See an

article by Giles Parkninson in RenewEconomy for details.

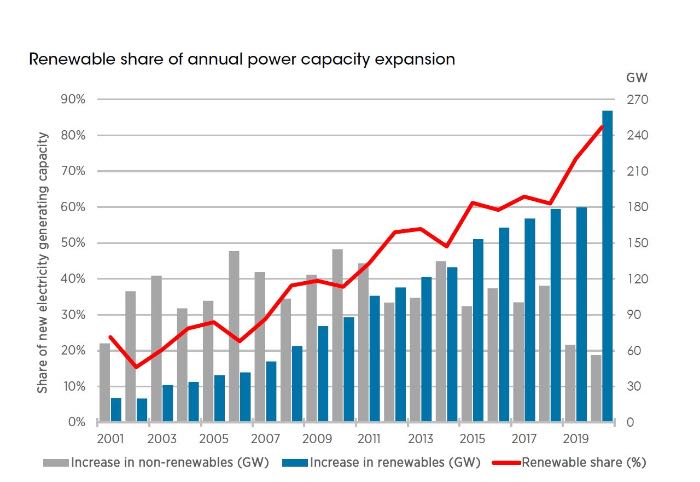

Fastest growth yet for renewables

June 2016

Matt McGrath reported for the

BBC on

2016/06/01 that:

New solar, wind and hydropower sources were added in 2015 at the fastest rate

the world has yet seen, a study says.

Investments in renewables during the year were more than double the amount

spent on new coal and gas-fired power plants, the Renewables Global Status

Report found.

For the first time, emerging economies spent more than the rich on renewable

power and fuels.

Over 8 million people are now working in renewable energy worldwide.

For a number of years, the global spend on renewables has been increasing and

2015 saw that arrive at a new peak according to the report.

About 147 gigawatts (GW) of capacity was added in 2015, roughly equivalent to

Africa's generating capacity from all sources.

China, the US, Japan, UK and India were the countries adding on the largest

share of green power, despite the fact that fossil fuel prices have fallen

significantly.

The costs of renewables have also fallen, say the authors.

"The fact that we had 147GW of capacity, mainly of wind and solar is a clear

indication that these technologies are cost competitive (with fossil fuels),"

said Christine Lins, who is executive secretary of REN21, an international

body made up of energy experts, government representatives and NGOs, who

produced the report.

The Renewables 2016 Global Status Report can be downloaded from

www.ren21.net.

| |

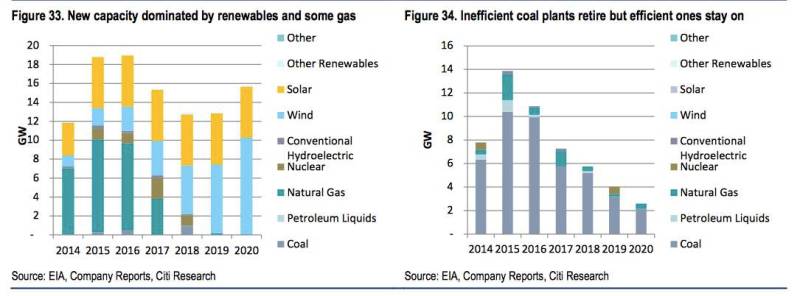

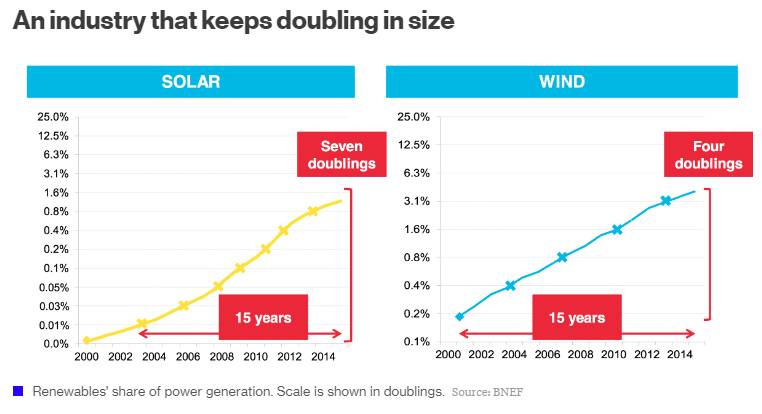

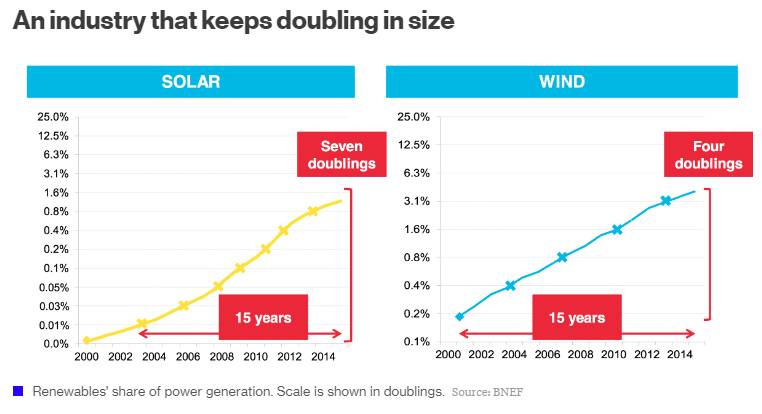

| | Graph source: BNEF

| |

Wind and Solar are Crushing Fossil Fuels

Another revealing report is

Wind and Solar are Crushing Fossil Fuels by Bloomberg New Energy

Finance, April 2016.

The graph at the right is just one of half a dozen from that report showing

how renewables were surging ahead at the cost of fossil fuels.

Solar 64% of new electricity in USA in the first quarter of 2016

Mike Munsell wrote in

Renew Economy that:

"In the first quarter of 2016, 1,665 megawatts of solar PV were installed in

the United States with the solar industry adding more new capacity during

this period than coal, natural gas and nuclear combined."

The

Abbott Government, which has been

corrupted by coal money, claims that other countries are not taking serious

action on reducing emissions, but

Australia's own

government climate change Net site has a page discussing the countries

of the world that are

already acting to reduce carbon dioxide pollution.

According to that site:

"A broad range of countries have introduced, or are planning, market based

emissions trading schemes and carbon taxes.

Australia's top five trading partners China, Japan, the United States

(US), the Republic of Korea and Singapore and another eight of our

top twenty trading partners (New Zealand, the UK, Germany, Italy, France, the

Netherlands, Switzerland and Canada) have implemented or are piloting carbon

trading or taxation schemes at national, state or the city level."

These countries, states and cities will all be trying to reduce their coal

consumption.

The Government is itself corrupt, but it has not yet managed to corrupt the

whole of the public service.

On 2014/11/05 Renew Economy reported that German Chancellor Angela Merkel is

proposing to implement "the strictest controls on coal fired generation yet

to be seen in Europe and to redesign its energy system around renewables".

| |

|

The Guardian

Indian workers walk past solar panels at the 200 megawatts Gujarat Solar

Park at Charanka in Patan district, India, Saturday, April 14, 2012.

Photograph: Ajit Solanki/AP

| |

India and China have been the great hopes of the Australian coal exporters.

Unfortunately for the exporters, both nations have terrible

air pollution

from their coal-fired power stations and both are trying to reduce their

use of coal and replace it with renewables.

Both nations also realise that building their own renewable energy facilities

will provide them with energy independence and security.

No nation wants to depend on others for its essential services.

The Guardian (2014/07/30) has

reported that China has ordered coal

power plants to close down in response to increasing air pollution problems.

It has been reported that Indian cities have the worst air pollution in the

world, elsewhere it has been claimed that China holds the records.

Whichever is true, both countries have huge problems.

In an article in

Renew Economy, 2018/08/22, by Tim Buckley and Kashish Shah, based on data from

Global Coal Plant Tracker, it was reported that while there were 600 GW of coal-fired power stations 'in the pipeline' back in 2010, 573 GW have since been cancelled.

An article written by Chris Lo and published in Power Technology on 2018/04/03 was headlined "The road to 100GW: lighting up India with solar power".

"Prime Minister Narendra Modi’s energy agenda has set an ambitious target for renewables, with an aim to increase renewable capacity on the grid from around 57GW in May 2017 to 175GW by the end of 2022. Around 100GW of that capacity is expected to come from solar photovoltaics (PV)."

The article continued to cover the decline of coal power and rise of renewable energy in India.

On 2016/06/10 Tim Buckley wrote a piece in

Renew Economy reporting that the:

"Indian Energy Ministry has this week announced plans to cancel four proposed

coal-fired power plants with a combined capacity of 16 gigawatts (GW).

The plans previously called for four ultra mega power plants (UMPP) across

Chattisgarh, Karnataka, Maharashtra and Odisha, but these are now to be

cancelled due to lack of interest from the host states.

This is yet another major policy shift underscoring how seriously India is

working to transform, modernize and diversify its electricity sector away

from coal."

To put this in perspective, the Loy Yang power station in Victoria has the

biggest capacity of any in Australia, at 3.25GW.

Plainly this will be a huge blow to the international coal industry and to

the Australian coal industry in particular.

India doubles its coal tax, again, March 2016

India introduced a coal tax in 2010.

Since then it has been doubled three times.

It is now about 30% of the wholesale price of coal.

Read more on

Institute for Energy Economics and Financial Analysis.

Published in

Solar Love, 2015/10/09, in a piece written by Jake Richardson.

Richardson wrote that Coal India Limited (CIL) "plans to finish a 250 MW

installation in the Madhya Pradesh area within twelve months."

CIL hope to build a further 750MW of solar when they find suitable sites.

It seems that CIL can see that coal has no future and that if they want to

stay in business they need to change to renewables.

In an

article titled "Australia's coal and

gas exports are being left stranded",

2014/11/21, Stephen Bygrave

wrote in The Conversation that "India has signalled its aim to end coal

imports within 2-3 years".

This shows the stupidity of the Liberal Queensland Government's plan of

bailing out the coal industry in

that state – with the aim of exporting coal to India.

Energy Matter, 2016/07/04, reported:

The World Bank Group says it hopes to provide more than $1 billion this year

to support India's goal of 100 gigawatts of solar energy by 2022.

"India's plans to virtually triple the share of renewable energy by 2030 will

both transform the country's energy supply and have far-reaching global

implications in the fight against climate change," said WBG President Jim

Yong Kim.

"Prime Minister Modi's personal commitment toward renewable energy,

particularly solar, is the driving force behind these investments.

The World Bank Group will do all it can to help India meet its ambitious

targets, especially around scaling up solar energy."

The figure represents the Bank's biggest funding package for solar power in

any country.

Support for the initiative will also be sourced from Clean Technology Fund

and from public and private investors.

Plainly this will greatly impact on the future use of coal in India.

On

2014/08/04 Natalie Obiko Pearson of Bloomberg

wrote:

India will provide low-cost loans and grants to set up solar power parks

across the country to host as much as 20 gigawatts of capacity, about

10 times what it has built to date.

[For comparison, at the end of June 2014, Australia had a total of 3.5GW

of small-scale solar PV installed.]

"We're preparing a scheme for solar parks and it will be out after cabinet

approval in about one month," said Tarun Kapoor, joint-secretary at the

Ministry of New and Renewable Energy.

India is planning some of the world's largest photovoltaic plants as it

seeks to scale down costs and boost generation.

It targets producing power from at least four so-called ultra-mega projects

at a maximum of 5,500 rupees a megawatt-hour, about 32 percent below the

global average, according to data compiled by Bloomberg.

The parks will host large plants ranging between 500 megawatts to 1,000

megawatts that will be connected to the grid.

Government subsidies will keep the price of land within the parks low to

contain project costs, Kapoor said.

That is more than three times the total of all Australia's wind power being

added in India every year!

See

article by Mridul Chadha in Renew

Economy,

2014/08/26.

In recent years India has added around 2000-3000MW of wind power each year.

India's new government is very pro-renewables.

Bloomberg carried an

article

written by Ganesh Nagarajan on

2014/09/12 reporting that the Ministry of

Renewable Energy will seek cabinet approval for installing 1000MW of off-shore

wind power by 2020.

World Nuclear News

reported

2014/12/11 that Russia and India signed a document that

"contains plans to build over 20 nuclear power units in India".

This will further reduce India's demand for imported coal.

The Economic Times of India published an

article on

2015/01/13 stating:

"Renewable energy developer and technology provider SunEdison has signed

an MOU with Karnataka government to develop five gigawatts of renewable

energy projects within the state over the next five years..."

At the end of 2013 the total installed utility-scale wind power in Australia

was about 3GW and there was a similar amount of solar PV.

Karnataka is one of the southern states of India.

"Adani is the prime player in the biggest thermal coal project in Australian

history, Galilee Basin.

The Galilee coal is to be shipped to India from terminals at Abbot Point

where, controversially, the plan is to dredge the port and dump the spoil out

to sea.

Without putting too fine a point on it, this is shaping up as the whitest of

white elephants.

No, more than this, this is an elephant which does not merely lack financial

viability but which is also a calamity for the environment."

From an

article by Michael West in the Sydney

Morning Herald, 2014/09/05.

September 2017; China heading toward 50% renewables by 2027

In an

article in RenewEconomy written by John Mathews, 2017/09/01, he shows

that wind, solar and hydro power are growing at an enormous rate in China.

Perhaps the most revealing point in the article is made by a graph that

shows the proportion of China's installed power capacity from wind, hydro and

solar having grown from 20% in 2007 to 35% in 2016, that is an average rate

of about 1.5% per year.

Obviously, if that rate continues for another ten years China will have 50%

renewable energy.

The original article, also written by John Mathews, was in Global Greenshift.

January 2017; China just scrapped 103 power plants

In a piece written by Peter Dockrill and published on

ScienceAlert on 2017/01/19:

"China has announced plans to cancel more than 100 coal plants currently in

development, scrapping what would amount to a massive 120 gigawatts (GW) of

coal-fired electricity capacity if the plants were completed.

In a directive issued this week, the country's National Energy Administration

cancelled planning and construction on 85 new coal plants, in addition to 18

facilities canned last year."

When China started its great economic and industrian growth a couple decades

ago it built many, many coal-burning power stations.

Since then China has had shocking air pollution, and now enough time has

passed for cancers to have developed.

"China's cancer rates exploding, more than 4 million people diagnosed in

2015, study says".

Written by ABC's China Correspondent Matthew Carney, 2016/03/24.

"In some of the industrial provinces, lung cancer rates have increased a

staggering four-fold" and the cause seems to be air pollution, largely due to

coal burning.

"Cancer has been the leading cause of death in China since 2010, with lung

cancer causing the most deaths."

A report in

China Daily stated:

"The decline of China's coal usage may have become a long-term trend,

according to experts, after official data on Tuesday showed that coal burning

in 2016 dropped for the third consecutive year."

Coal consumption in China in 2016 was 4.7% less than in 2015.

This came after an article in

Energy Matters, 2016/03/03, that cited a "Statistical Communique Of The People's Republic of China" in reporting a 3.7 percent decline in coal

consumption in 2015 following a decline of 2.9 percent in 2014.

Extracted from

The

Conversation, 2015/09/26.

China has confirmed that it will launch its national emissions trading scheme.

In a joint US-China climate statement, issued as part of President Xi

Jinping's state visit to the United States, China confirmed that its new

trading sytem will cover "key industry sectors such as iron and steel, power

generation, chemicals, building materials, paper-making, and nonferrous

metals".

This will reduce China's need for coal, both imported and domestic.

In early March 2015 a 104 minute

documentary titled

Under the Dome

and dealing with air pollution

in China had been viewed 200 million times in its first four days.

Importantly the documentary has been praised by Chen Jining, Environment

Minister.

Merrill Lynch have compared it to Al Gore's An Inconvenient Truth and

Rachel Carson's A Silent Spring.

According to the BBC, near the start of the film, Chai interviews a six year

old girl in the coal-mining province of Shanxi, one of the most polluted

places on earth.

"Have you ever seen stars?" Chai asks. "No," replies the girl.

"Have you ever seen a blue sky?" "I have seen a sky that's a little bit

blue," the girl tells her.

"But have you ever seen white clouds?" "No," the girl sighs.

| |

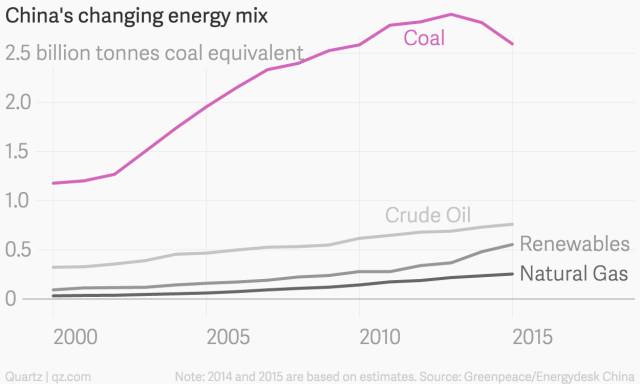

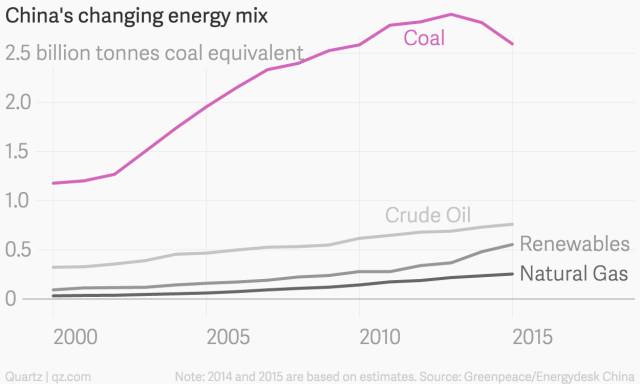

| From Quartz

|

|---|

| |

On-line news site

Quartz

produced a page written by Gwynn Guilford on 2015/05/15 under the heading

above; it included the graph on the right.

Guilford was refering to a report by Greenpeace-Energydesk.

Quoting from the original

Greenpeace-Energydesk article:

"Official data from China shows coal use continuing to fall precipitously

– bringing carbon dioxide emissions down with it.

The data – which comes months before crucial climate talks in Paris

– means China has cut emissions during the first four months of the

year by roughly the same amount as the total carbon emissions of the United

Kingdom over the same period.

The figures suggest the decline in China's coal use is accelerating after

data for last year showed China's coal use fell for the first time this

century.

An analysis of the data by Greenpeace/Energydesk China suggests coal

consumption in the world's largest economy fell by almost 8% and CO2

emissions by around 5% in the first four months of the year, compared with

the same period in 2014.

It comes after the latest data – for April – showed coal output

down 7.4% year on year amidst reports of fundamental reform for the sector.

China also recently ordered more than 1,000 coal mines to close."

| |

| The people of Beijing are reminded of what a clear sky looks like

|

|---|

| | Attribution "Feng Li/Getty Images"

| |

The Conversation published an article on

2014/08/25 regarding a statement by Ross Garnaut who

believes that "slowing economic growth, increasing energy

efficiency and growth in low-carbon electricity sources are driving" a

trend toward reduction in demand for coal.

He believes that demand for coal might peak as early as 2015 and then start

to decline.

Downward spiral of Chinese coal use

An

article in Think Progress written by Joe Romm published on 2015/12/04

provided evidence that peak coal use may have happened in China in 2013 and

that coal use was going into decline.

Just one day after the Indian solar article above, on 2014/08/05 Paul

Carston of the Financial Review

reported that:

"Beijing will ban coal use in its six main districts by the end of 2020,

state media cited the Beijing Municipal Environmental Protection Bureau as

saying, as the Chinese capital steps up efforts to combat air pollution.

In 2012, coal made up one-quarter of the city's total energy consumption,

Xinhua quoted official statistics as saying.

Fuel oil, petroleum coke, combustible waste and some biomass fuels will also

be prohibited as part of the effort to fight pollution, Xinhua said."

John Mathews and Hao Tan published a paper in the prestigious science

journal Nature which dealt with China's huge take-up of renewables.

Relevant to this page, Mathews and Tan suggested that if China is able to

reach its target of 550GW of renewables by 2017 it could reduce its imports

of fossil fuels by 45%.

(

The Conversation, 2014/09/11)

| |

| Projected energy sources in China

|

|---|

| | Graph credit Clean Technica

| |

An article by Sonia Aggarwal in

CleanTechnica

discussed a new study from China's Energy Research Institute, State Grid

Energy Research Institute and others "envisioning a nation powered by 57%

renewables in 2030, growing to 86% renewables by 2050, all at the same time

as China's economy grows sevenfold."

Note the major decline in coal.

In a

paper published in academia.edu

Lynette H. Ong reported that:

"The [Chinese] government aims to raise [the renewable energy] industries'

contribution to gross domestic product (GDP) from 5% currently to 8% by

2015 and 15% by 2020."

This trebling of China's already huge renewables industry will

boost the world-wide renewables sector at the cost of the fossil fuel sector.

Brian Robins wrote an article in the Sydney Morning Herald titled "Australian export risk on China dirty coal ban".

Brian wrote:

"A significant portion of Australia's coal exports to China could be at risk

from a Chinese government decision to block imports of lower quality "dirty"

coal from 2015, potentially hitting exports worth billions of dollars.

The government has decided to limit the use of imported coal with more than

40 per cent ash and 3 per cent sulphur in the three main coal-using regions

from January 1, 2015 in a bid to improve air quality, especially in the

major cities such as Beijing."

A consultant has estimated that the Chinese ban could affect more than half

of Australia's thermal coal exports to China.

Published in

Fusion, 2015/05/31.

Alex C. Madrigal wrote

... the market value of coal companies has collapsed.

The four largest coal companies were worth a combined $21.7 billion dollars

in June 2010. Now they're worth $1.2 billion.

Two other large coal concerns, Patriot and James River, have both filed for

bankruptcy in recent years.

And one market analyst told the Financial Times in February to expect

"multiple bankruptcies in US coal over the next 12-18 months."

Conor O'Sullivan wrote an article for Breaking Energy, 2015/03/25, headlined

Energy News Roundup: Coal Decline...

He went on to write:

The US coal sector is in terminal decline resulting with 26 companies

entering insolvency in the last three years, according to financial analysts.

"A report by the Carbon Tracker Initiative found that in the past five years

the US coal industry lost 76% of its value.

At least 264 mines were closed between 2011 and 2013. The world's largest

private coal company, Peabody Energy, lost 80% of its share price.

These declines were in spite of the Dow Jones industrial average increasing

by 69% during the same period.

Authors said this indicated a decoupling of US economic growth from coal.

In April 2016 Peabody filed for bankruptcy.

Research by analysts at Alliance

Bernstein suggests that nearly 230 million tonnes of coal will be removed

from US coal generation by 2020 the equivalent of Australia's

current level of coal exports.

This reduction is caused mostly as a result of the Obama Administration's

new emissions controls, but also because of the impact of the renewable

energy targets in place in 29 states.

This is an extract from a report by Giles Parkinson of 2014/09/15.

Quoting from Nine Reasons Why Thermal Coal is Struggling (and will continue

to do so) published in

RenewEconomy and written by Nathan Mim,

2014/08/13:

"Domestic coal is not so welcome at home anymore.

This is best seen in the US where in the past 10 years, they have gone from

exporting approximately 20 million tonnes to about 55 million tonnes at the

end of 2013.

Tightening legislation required existing power plants to upgrade their

emission equipment with some owners simply electing to close the facility as

the upgrade was too expensive.

With the latest US Environmental Protection Agency (EPA) rules on mercury

becoming enforceable on March 2015, the next major round of closures will

further destroy coal demand.

This coal is finding its way into the international coal markets further

expanding the gap between supply and demand."

Increasing coal exports from the USA and decreasing domestic consumption will,

of course, put downward pressure on coal prices.

Peabody Energy is one of the major coal miners in the USA and has coal mining

interests in Australia.

Renew Economy

reported in late April 2015 that Peabody is losing money on every tonne of

coal it mines in Australia and its share price has fallen 90% over the

past five years.

In April 2016 Peabody filed for bankruptcy.

The Conversation:

Peabody's bankruptcy claim is a symbol of coal's end.

Quoting from Desmog:

| |

Update 2015/08/05

Alpha Natural Resources Inc. filed for chapter 11 bankruptcy protection

|

|

"Another major U.S. coal company, Alpha Natural Resources (NYSE: ANR) hit a

new all-time low yesterday at just 27 cents per share, and sank as low as 24

cents that morning.

Arch Coal (NYSE: ACI) also hit its all-time low of 33 cents per share as

well, down from its all-time high of $73.42 in 2008.

All three companies' stock values are down roughly 80% from the beginning of

2015."

Quoting from Nine Reasons Why Thermal Coal is Struggling (and will continue

to do so) published in

RenewEconomy and written by Nathan Mim,

2014/08/13:

"For its next decadal goal, the EU has targeted a 40% reduction in

greenhouse gas emissions from 1990 levels by 2030.

A cut of this size will naturally force out the highest emitters or at the

minimum prevent their growth.

Amongst the highest emitting fossil fuels, coal will continue to be

friendless in Europe.

A more punitive price on carbon will make the EU's goal more easily

achievable.

At this time, carbon prices have been distorted by unintended policy

decisions but in time it is expected the 'right' structure will be found.

When this happens, we expect the cost of coal pollution will dramatically

increase the cost of coal-fired electricity and allow other, low emission

technologies to better compete."

As the EU imports less coal the international coal industry in general will

suffer.

|

|

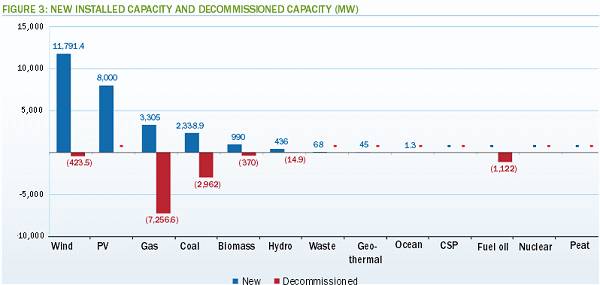

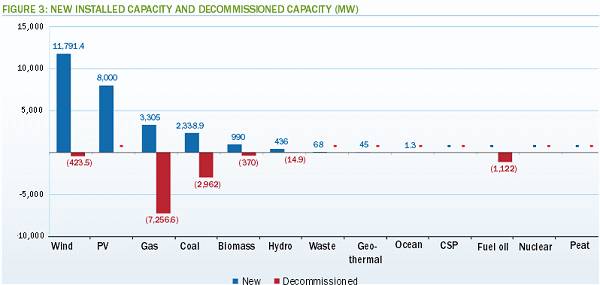

| Wind in power: 2014 European statistics, February 2015

|

|---|

| | Image credit: European Wind Energy Association

| |

The graph on the right is from

European Wind Energy Association.

It shows that more solar PV was installed in the European Union in 2015 than

gas and coal combined and that the amount of

wind power installed was more

than twice as much as gas and coal combined.

|

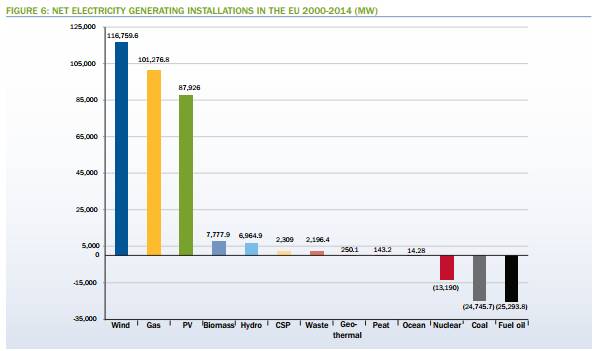

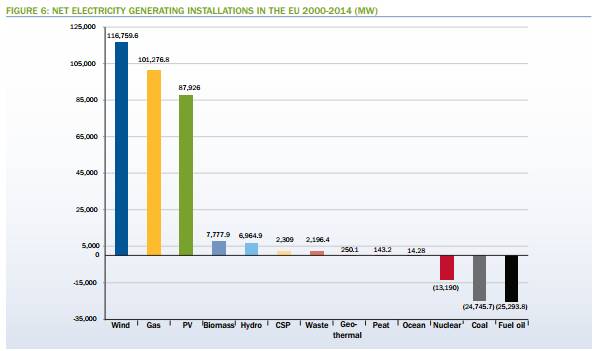

|

| Wind in power: 2014 European statistics, February 2015

|

|---|

| | Image credit: European Wind Energy Association

| |

The net coal-power generation capacity in the period from 2000-2014 was

strongly negative while wind, gas and solar PV installations were huge.

The

New York Times

reported on how the "Sun and Wind Alter Global Landscape, Leaving Utilities

Behind", 2014/09/13.

Germany is building huge wind turbines as far as 100km from the mainland as

well as massive solar PV installations.

The old fossil-fuelled utilities are facing devastating impacts.

| |

| A big screen reminds people in Beijing of what a blue sky looks like

|

|---|

| Air pollution purchased from Australia

Image source: FengLi/Getty Images

|

|

|

|

|

|

It has been known for a long time that air pollution from the burning of

fossil fuels is dangerous to people's health;

the

World Health Organisation (March 2014) has

estimated

deaths from air pollution at seven million people each year

and an article,

Electricity generation and health,

published in the prestigious medical journal The Lancet in 2007

put numbers to the deaths and serious diseases caused by burning coal to

generate electricity.

It can conservatively be estimated that the air pollution from the burning

of coal kills at least two million people world-wide each year.

I have written more on this on

another page on this site.

The governments of the more advanced developing nations have become aware of

this problem, to the cost of their peoples.

Several are trying to kick the coal habit and

adopt renewables.

Not only is Australia exporting coal; with the coal we are

exporting illness and death.

In a world that must stop burning coal because of the damage it is doing to

the climate and the oceans, this great additional harm amounts to a crime

against humanity.

We do not need to burn coal.

Renewables are quite capable of taking its place as has been shown in

South Australia which has gone from

near zero renewables in early 2003 to around 40% in 2014.

Report published in Nature 2015/09/16

A

report published in the prestigious journal Nature estimated that

outdoor air pollution "leads to

3.3 million premature deaths per year

worldwide".

"The contribution of outdoor air pollution sources to premature mortality on

a global scale":

J. Lelieveld, J. S. Evans, M. Fnais, D. Giannadaki and A. Pozzer.

Europe's Dark Cloud: How coal-burning countries are making their

neighbours sick

This

report found that:

- "EU's currently operational coal-fired power plants were responsible for

about 22,900 premature deaths in 2013: this can be compared to 26,000 deaths

in road traffic accidents in the EU the same year.

- The coal plants were responsible for 11,800 new cases of chronic

bronchitis and 21,000 hospital admissions in 2013.

- The health impacts of EU coal created an overall bill of 32.4 to 62.3

billion Euros."

The report involved a collaboration between Sandbag, Health and Environment

Alliance (HEAL), Greenpeace, Climate Action Network (CAN) Europe and WWF.

| |

| Morwell coal mine fire, February 2014

|

|---|

| | Image credit 350.org

| |

This coal mine fire burned in Morwell, in Victoria's Latrobe Valley, for

over a month, producing a huge amount of air pollution.

The Latrobe Valley, with its coal-fired power stations, is notorious for its

air pollution at the best of times.

| |

| Wind turbine

|

|---|

| | Generating electricity from a fuel that is inexhaustible and

free

| |

At the time of writing both solar photo-voltaic and on-shore wind power were

cheaper per installed megawatt and per megawatt-hour generated than building new coal-fired power stations.

The cost of wind power was gradually declining while solar PV prices continued

to fall sharply.

While the proportion of electricity generated by renewables is lower than

around 30% of the total electricity in a power grid their

intermittency does not cause problems,

as has been shown by the

South Australian experience.

South Australia's renewables were supplying around 40% of the state's

electricity at the time of writing (August 2014) and wind power alone

reached an average of

43% of the state's power in July 2014

with no problems.

Solar and other renewables were in addition of this.

Increasing Australia's renewables to 30% would not present any major

challenges to the supply-demand cycle.

In an

ABC article by Neal Woolrich mainly

about

Beijing's banning of coal use the

competition from gas was also discussed.

Woolrich wrote:

"The US shale gas revolution, and the push to renewable energy, are also

expected to dampen demand for coal in the decades to come.

Prices for solar continue to fall.

It has the potential to be a major disruptor for the coal industry because

it can generate power during the most profitable peak hours."

The article also mentioned that liquefied natural gas was likely to

provide more competition to coal in Australia.

| |

| Maules Creek coal mine

|

|---|

| Note that forest is being cleared to make way for this

unnecessary, polluting, and probably unprofitable mine.

Image source: maulescreek.org

| |

When I started writing this page in late July 2014 multi-national

Rio Tinto had just quit

their Mozambique coal project following a loss of more than $3 billion

dollars.

They were unable to proceed with it because no one would loan them the money

they needed to develop a mine; investment banks and individual investors are

seeing coal mining as a very

risky place to put their money.

Also see

Mining.com.

Coal deposits, which have cost millions of dollars to explore and evaluate,

have become embarrassments rather than assets.

A financial think tank named

Carbon Tracker has shown that

about 80% of the world's coal reserves can never be mined, yet the mining

companies involved are in denial; they all seem to believe that their coal

deposits can be mined, it is other companies that will miss out.

Obviously they can't all be right.

Many coal mining projects in Australia have been unable to raise the

investment needed to get them started.

According to

Greentechmedia,

while there are more than $60 billion of projects either publicly announced or

undergoing feasibility studies in Australia, only one project the

Whitehaven

Maules Creek Mine

is currently in development.

HSBC, Europe's biggest bank, and Deutsche Bank, Germany's biggest,

have stated that they were not interested in financing any coal mines that

would export from ports near Australia's Great Barrier Reef.

Some of Australia's largest coal deposits are in the Galilee Basin; if the

Galilee Basin coal is to be mined and exported economically it must be

shipped out through the Great

Barrier Reef, but this has unacceptable environmental consequences.

A

report published on 2020/05/28 by the

US Energy Information Administration noted that U.S. renewable energy consumption has just surpassed coal for the first time in over 130 years.

UK has its first coal-free day since the industrial revolution; Friday

21st of May 2017 was the first day that the UK went a full 24 hours without

burning coal to generate electricity in recent times.

| |

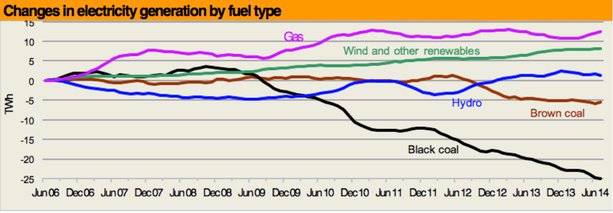

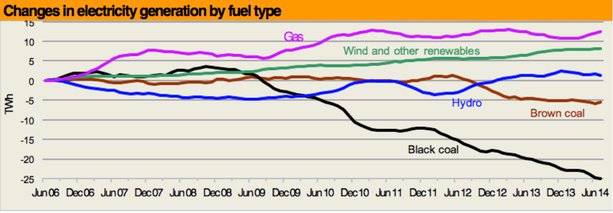

| Decline of coal-fired power in Australia

|

|---|

| Note that brown coal (mainly in Victoria) burned for power

generation has declined by about 5%, but black coal (NSW and Queensland)

has declined by a massive 25%.

It was not clear whether this was for the whole of Australia or just the

NEM (eastern states).

Image credit

Renew Economy

| |

On 2016/04/05

Climate Change News reported that Belgium was the seventh EU country to

go coal-free.

Even in Australia

Even here in Australia, where governments have been highly supportive of the

coal industry, coal-fired power stations are being shut down.

On 2016/04/08

ABC on-line news reported that Western Australia's Energy Minister was

to order 380 megawatts of generation capacity to be cut and that this would

almost certainly be made up of coal-fired power.

Simon Holms a Court wrote a piece in

Quora in December 2017, noting that 13 coal fired power stations had been shut down in Australia from 2012 to 2017.

None had been built in that period, nor looked like ever being built in the nation again.

Over several years up to the time of the original writing of this page

(August 2014) Australian

power prices have risen due to high and as it turned-out, unjustified

spending on increasing the capacity of the power grid.

This has caused electricity consumers to look for energy efficiencies at a

time when things like compact fluorescent and LED light bulbs became

financially viable.

At the same time, the costs of photo-voltaic solar power hugely declined and

more than a million Australian households installed their own power

generating systems.

This has all led to a decline in demand for electricity from the grid and

this, in turn, has impacted heavily on the profitability of coal-fired

power stations in particular.

|

|

| Energy Brix power station

|

|---|

| Shutting down

Image source Renew Economy

| |

The feed-back loop between;

- Rising prices;

- Declining demand due to economising in reaction to rising prices;

- Installation of solar power due to rising electricity prices

and declining solar power prices;

- Leading to declining demand from the power grid;

- Leading to rising prices as power suppliers try to maintain

profitability;

has been called the 'death spiral' of the power grid.

(More on

another page.)

South Australia

In South Australia the Thomas Playford coal-fired power station has been

closed and demolition has started.

The nearby Northern Power Station (NPS), also

coal-fired, was closed on 2016/05/09.

Victoria

Energy Australia will close the Yallourn power station in Victoria's Latrobe Valley in mid-2028, four years ahead of schedule.

In an

article written for ABC Gippsland by Jarrod Whittaker, it was explained that this highly polluting coal-fired power station had become too much of a financial liability and was to be scrapped and at least partially replaced with a 350 megawatt battery.

A few years earlier, also in Victoria's Latrobe Valley, infamous for it air pollution levels caused by coal mining and coal burning, the Energy Brix

coal-fired power station was being shut down (August 2014).

New South Wales

In January 2014 Energy Australia removed one half of the Wallerawang Power

Station from service and in March it placed the other half on 'three month

recall'; that is, it was not used but could be brought back into service at

three month's notice.

The Wallerawang Power Station is in NSW's Central Tablelands.

See Energy Australia's

Net site for more information.

The Newcastle Herald carried an

article

titled 'Coal industry decline in Hunter inevitable' written by Lee

Rhiannon on 22

nd May 2014.

Rhiannon wrote:

Of course what holds for coal mining profitability in the Hunter Valley

holds for the other of Australia's coal mining regions.

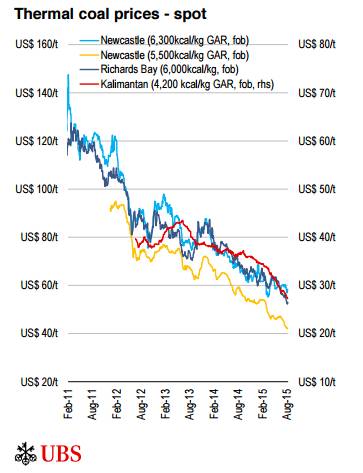

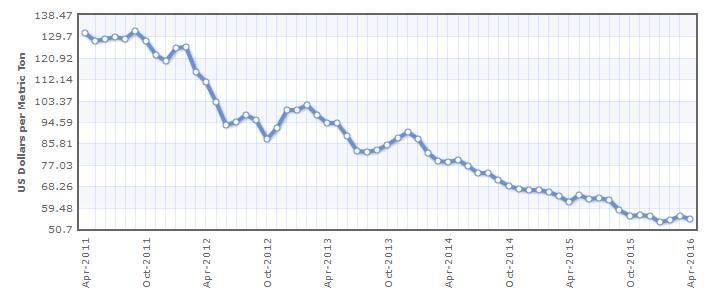

"The price of coal has dropped from $US130 a tonne in 2011 to $US81.50 now.

At least half of Australia's mines operate at a loss when the price of coal

is below $US87.

Elsewhere it has been noted that there is more employment now (mid 2014) in

the solar PV industry in Australia than in the coal industry.

Steep and continued decrease in coal-fired power generation leads to more

job losses

Just another small sign of the times

Akron Beacon Journal, Ohio USA, 2016/06/28, by Jim Mackinnon and Katie

Byard Beacon Journal business writers.

"A steep and continued decrease in the use of coal to make electricity is

largely responsible for costing 126 people their jobs at Babcock & Wilcox

Enterprises' facilities in Summit County.

The Charlotte, N.C.-based power generation company on Tuesday said it is

laying off more than 200 people – 126 in Barberton and Copley Township

– as it restructures its traditional power business in the face of

declining coal usage by electric utilities in the United States."

| |

| Maules Creek protest

|

|---|

| This elderly couple were arrested for peacefully protesting

at the proposed Whitehaven Maules Creek mine.

Photo credit SBS

| |

Considering all the signs of a poor future for the coal industry listed on

this page it is not surprising that those who are wanting to raise finance

for new coal mines are having difficulty.

According to

Greentechmedia,

while there are more than $60 billion of projects either publicly announced or

undergoing feasibility studies in Australia, only one project the

Whitehaven Maules Creek Mine is currently in development and that

mine is facing huge opposition from environmentalists.

Australians who are intelligent enough to see the damage that climate change

will bring with it, and who have not been corrupted by the greed that is

associated with the coal industry, are fiercely opposed to allowing any more

coal mining.

|

|

Warrumbungle Shire to switch to solar?

This sort of action will become more and more common.

Sophie Vorrath reported (2014/08/07)

that the Warrumbungle Shire Council is expecting a huge increase in the cost

of public lighting and is consequently investigating installing solar PV on

all its suitable buildings (between 80 and 100).

This decision follows a plan by state government owned network operator,

Essential Energy, to increase its charges.

If it is viable for the Warrumbungle Shire to go solar, it will probably also

be for all other NSW rural shires.

|

|

The retail price of electricity has increased.

It will increase further; for at least two reasons:

- With the export of natural gas from the east coast, domestic natural

gas prices will rise to meet export parity;

- Reduction in consumption has meant that the cost of maintaining the

power grid increases relative to the amount of power consumed.

This has resulted in what has been called the

death spiral of the power grid;

increased prices lead to electricity conservation producing decreased

consumption leading to increased prices leading to further economies and

decreases in consumption, etc. etc.

There will be further adoption of solar photo-voltaic electricity, especially

for 'behind-the-meter' situations, such as in shopping centres, warehouses,

factories, councils, etc.

This will also reduce the amount of electricity coming from the grid.

Unless the Abbott Government totally abolishes the Large Scale Renewable

Energy Target there will be more wind power, solar PV, and possibly solar

thermal power generation built.

With less electricity consumption and increasing wind and solar power,

coal-generation will tend to be pushed out of the Australian market.

Suzanne Goldenberg wrote an

article in the Guardian on 7

th

August 2014.

She reported that a number of prominent US public relations firms had

said that they will "not take on clients or campaigns that deny climate

change".

Climate science denial has been one of the main tools of the coal industry.

So long as they can make a lot of people believe that climate change is not

real they have a chance of keeping their killer industry alive.

Their disinformation campaign has been very effective in the past, but with

the big PR firms refusing to cooperate in the future they will find it a lot

harder to pull the wool over anyone's eyes.

Electricity consumption has decreased, renewable energy generating is

increasing, but generation by coal-fired power stations continues.

According to RenewEconomy about 40% of all Australian seaborne coal is

unprofitable, but mining continues because the miners have contracts they

have to fill.

Overproduction will only stop when these mines close down.

See Nine Reasons Why Thermal Coal is Struggling (and will continue to do so)

RenewEconomy, written by Nathan Mim,

2014/08/13.

On 2014/08/20 Giles Parkinson

reported in RenewEconomy that AGL had

taken over the 2000 megawatt Liddell coal-fired power station from the NSW

Government in the Hunter Valley for $0.

It seems that AGL realised that the cost of the decomissioning of the old

power station would be about as much as any profit they were likely to

get out of it.

This is an old power station, commissioned between 1971 and 1973.

It will be interesting whether, with the continued decline in the coal

industry, AGL finds that the price may have been too high.

Or perhaps the bosses at AGL have been assured by our Federal Government that

they will make sure that coal continues to be looked after?

In September 2017 the Liddell power station was again in the news when the

Turnbull Government discussed its

aim of

keeping the old power station

going for five years past the date at which AGL proposed to close it

down.

In February 2019 Switzerland-based Glencore, the biggest miner of coal in Australia, announced that it was going to limit its coal mining.

According to

The Guardian Glencore was responding to concern within the investment community, including the Church of England, which was a big investor in Glencore.

Forbes suggested that this would make Adani's proposed Galilee Basin coal mine less likely to ever happen.

In mid-January 2016 Arch Coal, the second largest coal supplier in the US

filed for bankruptcy.

On 2014/10/29

Mining Weekly

reported that Centenial's 30-year old NSW Angus Place mine near Lithgow

would be placed on care and maintenance in November.

In July 2016 Rio Tinto was trying to

sell its big Blair Athol coal mine for $1.

Coal-fired power stations were shutting

down, greatly reducing the demand for coal.

Huge US coal company

Peabody energy was in deep financial

trouble.

In October 2014 Rio Tinto

sold its $3.7b Mozambique coal business for $50m.

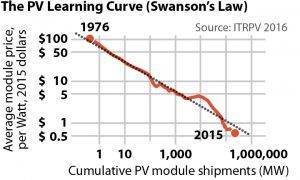

Gerard Wynn wrote in RTCC News 2015/03/05 that Deutsche Bank was expecting a continued decline in solar PV

prices causing increasing inroads into fossil fuels.

They suggested that solar PV prices could fall another 40% by 2020.

Solar PV prices continue to fall through to May 2017

(the time of writing this piece)

Elsewhere on this page I have written about

India cancelling coal power projects.

The cause of the cancellations was the continuing rapid fall in the cost of

solar power.

Quoting an article from

IEEFA (Institute for Energy Economics and Financial Analysis):

"India solar tariffs have been in freefall for months.

A new 250MW solar tender in Rajasthan at the Bhadla Phase IV solar park this

month was won at a record low Rs2.62/kWh, 12 percent below the previous

record low tariff awarded across 750MW of solar just three months ago at

Rs2.97/kWh."

The graph on the right is a record of the cost of solar PV compared to

cumulative PV module shipments.

It shows a relationship known as

Swanson's Law

which states that the price of solar photovoltaic modules tends to drop 20

percent for every doubling of cumulative shipped volume.

| |

| Sundrop Farms – the solar power installation

|

|---|

| |

Photo taken with my drone

| |

Not only is solar photo-voltaic financially competitive and booming, but

solar thermal power is moving steadily ahead.

On 2017/08/14 Australia's

first solar

thermal power station was announced.

The South Australian government has contracted to buy a large part of its

output for a very reasonable $78/MWh maximum.

Solar thermal power in already in use in Australia at places like

Sundrop Farms, Port

Augusta, South Australia.

May 2015 –

The Institute for Energy Economics and Finanicial Analysis (IEEFA)

reported

that "The Stowe Coal Index, an index of leading global coal stocks, has

lost 71% of its value over the past five years."

IEEFA's Tom Sanzillo went on to say

"Coal markets globally are in the midst of a wrenching structural decline.

No investment fund in the world – be it university, pension or

institutional – can make a compelling financial case to hold these

equities in their portfolio any longer.

The coal industry has failed to compete with other energy resources,

particularly wind, solar and energy efficiency.

Its various export and trading schemes have only resulted in further

deterioration of share value.

Coal stocks are losing money every day.

No investment policy that I am familiar with can holding stocks in an

industry with catastrophic losses and with no realistic case for an upside

for the foreseeable future."

The above was taken from publications by RenewEconomy and IEEFA.

Hellenic Shipping News: Commodity News, 2015/07/28:

"One of the world's largest coal companies in terms of reserves, Arch has

seen its stock slump some 99.7% in the past five years to 20 cents recently."

"Mainly used for power generation and metallurgy, the percentage of U.S.

electricity from coal-fired plants recently fell to 30%, just below the

share from natural gas, according to SNL Energy.

Five years ago, coal had twice the share of gas at 44%."

The

Abbott Government has chosen to

ignore the evidence and go on supporting the coal industry.

There can be little doubt that this will be to the detriment

of the long-term future of the national economy and of the environmental

health of the planet.

Lisa Cox wrote an 'exclusive' in the

Sydney Morning Herald, 2015/06/30.

Quoting from the article:

Documents released under Queensland's freedom-of-information laws show

officials at the highest level of the Queensland Treasury held grave doubts

about Indian mining company Adani's capacity to see through its Carmichael

coal mine project in central Queensland even as former premier Campbell

Newman was promising taxpayer funds to help establish the mine.

Hundreds of pages of correspondence from senior figures in the Queensland

department, including former under treasurer Mark Gray and principal

commercial analyst Jason Wishart, express fears about Adani's high level of

debt and identify the mining giant as a "risk" because of its unclear

corporate structure and use of offshore entities.

In one document, an email from November last year, days before an

announcement that the Newman government would help Adani build its rail,

Projects Queensland principal commercial analyst Jason Wishart wrote to

David Quinn, the executive director of Projects Queensland: "It is unlikely

to stack up on a conventional project finance assessment."

Mine rehabilitation

In August 2016 a

leaked

Queensland government report stated that funds invested by coal mining

companies were likely to be inadequate for rehabilitation of the coal mines

in the state by something like Aus$3.2 billion (US$2.4 billion).

The Australian taxpayers would have to make up this short-fall.

The report was titled 'Targeted Compliance Programme Report on Financial

Assurance for Queensland Coal Mines (TCP-009)'.

It was written by the Department of Environment and Heritage Protection and

was dated 29 January 2016.

Galilee Basin

In November 2014 the Queensland government has invested tax-payer's money

in developing the Galilee Basin and associated infrastructure because

private financiers didn't want to touch it.

Tim Buckley, Director of Energy Resource Studies Australasia at the

Institute for Energy Economics and Financial Analysis (IEEFA) has been

reported as saying:

"The people of Queensland and Australia should be outraged at this idea of

questionable politicians spending many billions of tax payer dollars to make

an unviable, unwanted and dangerous mega coal project a reality"

"Many would consider this a Government simply pissing taxpayers' money up

against the wall."

This is typical of Australian

Liberal governments attempting to prop

up the coal industry in spite of evidence that it is an industry of the

past.

(Also see

Renew

Economy.)

CCS technology has been touted as a way of keeping the coal industry alive at the same time as getting rid of the CO

2 emissions (there are reservations about leakage from the underground storages).

While injecting CO

2 underground has been used to enhance oil recovery in ageing oil-fields, so far as I have been able to find out no power station anywhere in the world has successfully used CCS.

By 2015 renewables were around financial parity with new-built coal-fired power stations even without the huge additional cost of CCS, by 2021 renewables costs had fallen to the point where they were cheeper than coal-fired power without CCS.

CCS just does not stack up from an economic point of view aside from any environmental concerns.

| |

How could CCS ever be financially viable?

Quoting from

Wikipedia 2017/06/30: "Capturing and compressing CO 2 may

increase the energy needs of a coal-fired CCS plant by 25-40%.

These and other system costs are estimated to increase the cost per watt

energy produced by 21-91% for fossil fuel power plants.

Applying the technology to existing plants would be more expensive,

especially if they are far from a sequestration site.

|

|

Two major blows to CCS within a few days, late June 2017

After spending US$7.5 billion (Aus$10 billion) on a 'clean coal' project that

would have included carbon capture and storage, Southern Co, parent

company of Mississippi Power announced that the project would be dropped.

See articles in

RenewEconomy and

MIT Technology Review.

European power giants Engie and Uniper

pulled out of a CCS test project in the Netherlands.

Big project dropped by US DoE

News, 2015/02/05, from RenewEconomy:

FutureGen's demise another blow to CCS "FutureGen 2.0 coal

power project in Illinois has collapsed following a US Department of Energy

decision to withdraw funding for the plant".

In a move of perhaps even more symbolic importance than practical

importance, although that too should not be underestimated, the leaders

of the UK's three main political parties have pleged a cross-party fight

against climate change, including a promise to end the use of unabated

coal.

For more read

ReNews

2015/02/14.

In November 2015 the UK Government

announced

that all coal-fired power stations not having carbon capture and sequestration

technology would be closed by 2025.

| |

Link

For more information –

Killer coal – how the burning of coal

kills millions each year.

|

|

The following was extracted from The Lancet: Health and climate change

The 2015 UCL-Lancet Commission on Health and Climate Change was formed to

map out a comprehensive response to climate change, in order to ensure the

highest attainable standards of health for populations worldwide.

The Commission is multidisciplinary and international in nature, with strong

collaboration between academic centres in Europe and China.

10 Policy Recommendations

Responding to climate change could be the greatest global health

opportunity of the 21st century.

To help drive a transition to a low-carbon economy, over the next five

years, the Commission recommends that governments:

[The emphasis on the points particularly relating to the end of the coal

industry is mine.]

- Invest in climate change and public health research, monitoring, and

surveillance

- Scale-up financing for climate resilient health systems world-wide

- Protect cardiovascular and respiratory health by ensuring a rapid

phase out of coal from the global energy mix

- Encourage a transition to cities that support and promote lifestyles

that are healthy for the individual and for the planet

- Establish the framework for a strong, predictable, and international

carbon pricing mechanism

- Rapidly expand access to renewable energy in low-income and

middle-income countries

- Support accurate quantification of the avoided burden of disease,

reduced health-care costs, and enhanced economic productivity associated

with a low-carbon economy

- Facilitate collaboration between Ministries of Health and other

government departments, empowering health professionals and ensuring that

health and climate considerations are thoroughly integrated in

government-wide strategies

- Agree and implement an international agreement that supports countries

in transitioning to a low-carbon economy

- To help drive this transition, the 2015 Lancet Commission will develop

an independent Countdown to 2030: Global Health and Climate Action, designed

to monitor progress on the implementation of climate change policies that

promote health over the next 15 years.

The

world's

public health leaders have called for an end to coal because of ACC and

coal's more immediate health impacts due to air pollution (2015/02/16).

Quoting from a

Healthy Energy Initiative

media release:

At the close of their international conference in Kolkata, as part of a

broad "Call to Action for Public Health," the world's public health

associations advocated "a rapid phase-out of coal" to limit further global

warming and prevent illnesses and deaths associated with air pollution.

The Healthy Energy Initiative welcomed the Call to Action released at the

World Congress on Public Health, hosted by the Indian Public Health

Association and attended by more than 1,600 delegates.

The Call to Action points to the "contribution of fossil fuels and coal in

particular to climate change as well as to detrimental impacts on the health

and wellbeing of local communities."

President of the World Federation of Public Health Associations Dr Mengistu

Asnake said the emphasis on fossil fuels as drivers of climate change and

risks to community health in the statement "highlights their contribution to

a massive burden of illness and death worldwide."

"Millions of lives are at risk from climate change and the carbon intensive

global economy," Dr Asnake said, citing World Health Organization figures

that seven million people die every year from air pollution, of which coal

is significant contributor.

Of course it is well known that the burning of coal produces air pollution.

The pollution has two effects:

- Some of the air pollution, which includes mercury, oxides of sulfur and

nitrogen and various particles, is toxic to people and other animals;

- The carbon dioxide is one of the main causes of climate change and

ocean acidification.

But in addition to the pollution caused by burning coal there is the

pollution caused by just mining the coal.

Environmental Justice Australia

April 2015; National Pollutant Inventory data showed large increases in

air pollution from coal mining in the last five years.

Quoting from Environmental Justice Australia:

"New analysis of the latest annual National Pollutant Inventory (NPI) data,

and mapping of trends in the preceding five years, shows big hikes in air

pollution from the nation's coal mines, coal fired power-stations and coal

terminals."

- Coal mining is Australia's leading source of particle pollution.

Coal companies reported 435,000 tonnes of PM10 in the latest 2013-14 NPI

report, 47% of the national total.

This represents a doubling in PM10 emissions in just five years.

- Emissions of toxic pollutants from coal mines including PM10, lead,

arsenic and fluoride increased by 100-200% during the last decade.

- Particle pollution (PM10) emissions from the nation's ten most

polluting mines increased by between 48% and 1030% during the last five

years.

- Australia's 20 most polluting coal mines are located in the Bowen Basin

(QLD) and the Hunter Valley (NSW).

- Victoria's Latrobe Valley is home to Australia's four highest emitting

coal-fired power stations.

PM10 emissions from electricity generation increased in the Valley by 28%

during the last five years and PM2.5 (dangerous fine particle) emissions

increased by 27%.

- Newcastle's three massive coal terminals are that city's top source of

PM10 and have seen a 70% increase in emissions over five years.

- Air pollution contributes to the premature death of over 3,000

Australians every year alone, with coal a major contributor."

2015/06/02

The CEOs of the six European oil giants Shell, BP, Total, Statoil, Eni and

BG Group last Friday sent letters to the head of UN climate negotiations,

Christiana Figueres, asking for a price on carbon emissions.

See

RenewEconomy.

It seems that the aim is not a sudden altruism on the part of the oil giants,

but rather a desire to remove some competition.

However, whatever the motivation, it is yet another blow to coal.

The French company that owns the infamous coal-fired Hazelwood power station

in Victoria's Latrobe Valley has 'signalled a big push against coal-fired

generation'.

The company, previously named GDF Suez, now Engie, is pushing for a

transition to gas, wind, solar and nuclear.

For more see an article by Giles Parkinson in

Renew Economy, 2015/06/17.

| |

|

This section added 2015/06/05

|

|

Progressive organisations, such as IKEA, can see the way the world must go

and is going.

Sophie Vorrath wrote a

piece

for RenewEconomy on 2015/06/04 about IKEA investing six hundred million

euros in renewable energy as part of a billion euro climate change funding

plan.

Quoting the RenewEconomy article:

... "IKEA Group said the majority of the 600 million euro figure would be

invested in wind energy (500m euros), while around 100 million euros would

be invested in solar up to 2020.

The new funding commitment builds on the 1.5 billion euros the manufacturer

has invested already in wind and solar since 2009 – including the

3.9MW of rooftop solar PV systems it is building across all of its

Australian east coast stores and warehouses."

| |

|

This section added 2020/11/24

|

|

In an

article in Renew Economy, 2020/11/23, Giles Parkinson wrote that:

"The Queensland zinc refiner Sun Metals has announced it will go 100 per cent renewables, and will add further capacity to pursue “green hydrogen” opportunities in transport and export in what is being regarded as one of the most significant developments in Australia’s energy transition.

The decision by the South Korean owned Sun Metals refinery – the second biggest single energy user in Queensland, and one of the biggest in Australia – to reach 100 per cent renewables by 2040 has been described as a “tipping point” by Jon Dee, the Australian head of the RE100 initiative."

My emphasis above, this is not some obscure little business, it represents another step toward the death of the fossil fuel industries.

At present (June 2015) governments are spending billions of taxpayers' dollars

each year on subsidies for the world's coal industry.

Considering the harm that the burning of coal is doing – air pollution,

climate change, ocean acidification – this is plainly

unethical and is being exposed as such.

As can be seen elsewhere on this page, the coal industry has a very bleak

future.

Governments will be forced to reduce coal subsidies and as they do the

decline in the industry is likely to become a catastrophic collapse with huge

financial losses for those who have invested in coal.

In an article

titled "Under the Rug: How Governments and International Institutions are

Hiding Billions in Support to the Coal Industry" David Tumbull revealed how

much government money around the world is going into coal subsidies.

IMF report May 2015

The

IMF

increased its previous estimate of the subsidies going to (mainly) fossil

fuels.

They put the figure at $5.3 trillion per year (or about $10 million per

minute).

This is more than the total spending on health of all the world's governments

and largely relates to polluters not paying the costs – social welfare,

health, environmental and broader economic – imposed on governments for

the burning of coal, oil and gas.

Writing in the Sydney Morning Herald Mark Kenny and Lisa Cox wrote a

piece

headlined "Unprecedented alliance of peak bodies pressures PM over climate

change".

The group, calling itself a climate round table, includes the two most

recognised and powerful employer organisations, the Australian Industry

Group and the Business Council of Australia as well as the Australian

Aluminium Council, Australian Industry Group, The Climate Institute,

Australian Conservation Foundation, Business Council of Australia, WWF

Australia, Australian Council of Social Service, Energy Supply Association

of Australia, Australian Council of Trade Unions, and Investor Group on

Climate Change.

Quoting from the SMH article:

"The group wants to set the path for policies that reduce financial risk,

encourage investment in low and zero-carbon technologies, and help avoid an

increase in global temperature of greater than 2 degrees centigrade above

pre-industrial levels."

The alliance wants to push PM Abbott toward making firm and significant

commitments ahead of the Paris climate summit in December (2015).

The stated Principles of the Climate Roundtable included the following (of

particular relevance to The End of Coal):

"Achieving this goal will require deep global emissions reductions, with

most countries including Australia eventually reducing net greenhouse gas

emissions to zero or below."

Also see the

full statement

of the Joint Principles for Climate Policy of the Climate Roundtable.

In an

article written by Michael W Kahn for

ECT.coop a top US railroad executive lamented millions of dollars spent in

upgrading railways for transporting coal in the Powder River Basin.

He expected continued decline in the use of the railways and that they would

become stranded assets.

| |

|

This section added 2018/05/22

|

|

In May 2018 "a new report from Bloomberg New Energy Finance forecast that demand for copper, high-purity nickel, cobalt and lithium used in the manufacture of EV [electric vehicle] battery packs was forecast to rise 31 times, 42 times, 19 times and 29 times respectively to 2030, as sales of EVs soar to 30 million by 2030."

Sophie Vorrath wrote a summary for

RenewEconomy on 2018/05/22.

"At current commodity prices, BNEF says, the supply of these materials for batteries would be worth $US75 billion in the year 2030."

What wasn't mentioned in the RenewEconomy article was the fast-growing market for home batteries and utility-scale batteries.

These may well prove to be a greater growth industry than EV batteries.

Statements from representatives of religions and denominations on the need

for action on climate change...

The rats are leaving the sinking ship!

Western Australia Energy Minister and State Treasurer (and once head of the

notoriously right-wing think tank the Institute of Public Affairs, IPA), Mike Nahan, recognised that coal is on the way out and solar the way of the future. In June 2019 he

resigned as leader of the WA Liberal Party.

He had said in August 2015 that solar PV would meet the daytime electricity needs of WA within the next decade, that solar was cheap and democratic and was likely to account for all new generation capacity, and it would displace the state’s ageing coal generators.

For more detail see the Renew Economy article by Giles Parkinson, 2015/08/28.

Giles Parkinson

wrote again 2016/05/30:

The two men who ran Australia's two dirtiest brown coal generators, and who

were one-time trenchant critics of climate and renewable energy policies,

have switched sides.

They have now thrown in their lot with the solar industry and other

disruptive technologies.

Tony Concannon is the former Australian boss of GDF Suez, now Engie,

which operates the Hazelwood brown coal generator, among other assets.

He has now re-emerged as the chief executive of Reach Solar, which is looking

at solar projects and battery storage across Australia, including a 200MW

solar PV facility located near Port Augusta airport.

Richard McIndoe is the former head of Energy Australia, which owns the Yallourn

power station...

Indian mega coal mining company, Adani, seems to have seen the writing on the

wall.

It has announced 650MW of solar PV development that it intends to build in

Australia and a colossal 10GW (10,000MW) in India.

A company spokesman said they still want to go ahead with their Carmichael

coal mine in Australia, but nobody else (apart from some Australian

governments) seems to see it as being viable.

RenewEconomy, 2016/05/25.

Australia

In November 2018 there were

20 wind farms and many large solar PV farms under construction in Australia.

No one was even considering building a coal-fired power station – the reasons were mainly to do with the economics.

The 'Big Three Gentailers' (generators and retailers) of power have all stated that new coal-fired power stations are not economically competitive with renewables, and the 'Big Four' banks have all made statements indicating that they would not be interested in investing in new coal-fired power stations.

Australia and elsewhere

Stuart Connie reported in

The Australian, 2018/11/14, that Australia's biggest bank, the Commonwealth, will get 65 per cent of its energy from renewables starting in January 2019.

He wrote that:

"CBA has become the first Australian firm to commit to the global RE100 initiative, joining corporates including Apple, Bank of America, Coca-Cola, Nike, Sony and Starbucks in committing to source 100 per cent of their electricity from renewables by a specified year."

A US example

Jon Walter reported 2015/09/24 on

RenewEconomy

about nine huge US corporation that had pledged to go to 100% renewable

energy.

They included "Fortune 500-listed companies Goldman Sachs, Johnson &

Johnson, NIKE, Inc, Procter & Gamble, Starbucks, Steelcase, Voya Financial,

and Walmart".

On 2015/09/23 Henning Gloystein for Reuters reported that:

- Coal futures have tumbled 77% since 2008;

- Coal has fared worse than oil and natural gas;

- Goldman Sachs says coal demand will peak before 2020;

- Goldman Sachs said coal is in terminal decline.

| |

| Galilee Basin in the NE Australian state of Queensland

|

|---|

| | Image credit galileebasin.org

| |

There are huge coal reserves in Australia's Galilee Basin, but it is highly

unlikely that mining them will ever turn a profit for anyone.

There are a number of reasons that the coal resources of the Galilee Basin

should never be developed:

- They are not economically viable;

- Burning the coal from the Galilee Basin would add hugely to carbon dioxide

emissions and to the anthropogenic climate change problem;

- The coal would have to be shipped out through the Great Barrier Reef and

that would pose very high risks to the world's greatest coral reef system.

The only way that the Galilee Basin coal could ever be mined is with huge

and unconscienable

subsidation by Australia's

taxpayers.

As the whole of this page shows, coal has no financial future.

If a mine in the Galilee Basin was opened it would have a very short life and

would be a financial disaster for Australia.

For more see

Economics and finance of the Galilee Basin and

The financial viability of the Carmichael mine in the Galilee Basin.

As

reported on 2015/12/23 by Matt Peacock on the ABC, black lung or coal

miners' pneumoconiosis, has recently been confirmed in four cases in Queensland

coal mines.

The mining union, the CFMEU, has told the underground mining industry that

they need to improve underground miners' working conditions.

This will, of course, increase costs and reduce the attractiveness of coal

as an energy source.

According to a paper published in

The Lancet (a highly prestegious medical journal) globally 25,000 people

died of black lung in 2013 alone.

In Australia, and no doubt elsewhere, new coal-fired power stations were not being built (for a number of reasons, including environmental and financial) and the old ones were becoming unreliable.

As Giles Parkinson reported on

Renew Economy, 2017/12/20, "A 700MW unit at the Eraring coal fired power station in New South Wales tripped on Monday afternoon, taking to four the number of big coal units that have failed without warning in less than a week.

The failure of the Eraring unit at 6pm on Monday follows unexpected trips at of a 420MW unit at Milmerran in Queensland on Tuesday, a 700MW unit at Mt Piper in NSW on Wednesday, and a 560MW unit at Loy Yang A (unit 3) in Victoria on Thursday."

Energy analysts forecast 'the end of coal' in Asia as Japanese investors back renewables; an article by Ben Smee and Daniel Hurst in The Guardian, 2019/03/18.

Quoting from the article:

Australia’s largest export customer for thermal coal is scrapping plans to build power plants.

Major Japanese investors, including those most indebted to coal, are seeking to back large-scale renewables projects across Asia, marking a “monumental” shift that energy market analysts say is “the start of the end for thermal coal”.

At the same time, Japanese banks and trading houses are walking away from coal investments, selling out of Australian mines and scrapping plans to build coal-fired power.

Smee and Hurst noted that Global Coal Plant Tracker sugested that three quarters of the proposed coal-fired power stations in Japan were unlikely to proceed.

Peter Hannam wrote in the

Sydney Morning Herald 2018/09/17, that

Japan's Marubeni Corporation, one of world's largest developers of coal plants, was reported to be withdrawing from new projects.

Quoting from Hannam's article:

"Japan's Nikkei said Marubeni would also halve the ownership of plants it already held by 2030 and accelerate its shift to renewable energy.

Tim Buckley, an analyst with anti-fossil fuel group the Institute for Energy Economics and Financial Analysis, said the news that Marubeni was shifting its global weight behind renewables was "a bodyblow to the global coal industry and a profoundly important endorsement of the aims of the Paris Climate Agreement".

"It is inevitable that other global coal plant developers like POSCO of South Korea, Siemens of Germany and GE of America will be forced to evaluate their own position in light of Marubeni’s decision," he said."

The Newcastle Herald carried an

article

titled 'Coal industry decline in Hunter inevitable' written by Lee

Rhiannon on 22

nd May 2014.

Rhiannom mentioned that Japan, Australia's key long-term customer, was pushing

the downward trend in coal prices.